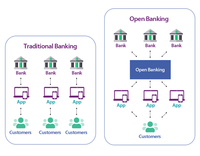

Open Banking may have started as a bank-led initiative, but the ecosystem has expanded into a much more diverse and collaborative landscape. Traditional banks remain important players, particularly in safeguarding sensitive financial data and ensuring compliance with rigorous global standards. Evolving regulations such as PSD3 in the EU and the U.S. Open Banking rules introduced in 2024 have strengthened requirements not only for banks but also for fintech providers, ensuring consistent levels of security and consumer protection across the industry.

At the same time, customers are increasingly turning to fintech-first solutions—such as neobanks, digital wallets, and payment apps—as their primary financial touchpoints. These services now plug directly into bank data via standardised APIs without relying on outdated methods like screen scraping, which has been largely phased out worldwide.

For financial institutions, Open Banking APIs still provide a powerful way to modernise legacy systems, but they also serve as a gateway to partnerships with fintechs and non-bank platforms. Through embedded finance and emerging Web APIs (such as WebGPU and WebML), web applications can deliver performance and functionality once reserved for native apps, reducing the traditional advantages of being a dedicated mobile banking platform. Even offerings like Google Maps integration, once seen as exclusive to Android, are no longer defining differentiators.

Looking ahead, Open Banking is now viewed as a mature global framework, with momentum shifting toward Open Finance, which broadens access to investment, insurance, and pension data, and Open Data, which extends interoperability beyond banking into wider sectors. Additionally, AI-driven predictive banking is becoming a core feature of many Open Banking APIs, enabling real-time insights and personalised financial guidance that reshape how customers interact with their money.